hyUSD Ecosystem Incentive Program

hyUSD Ecosystem Incentive Program

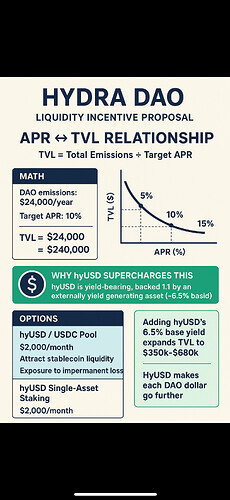

To bootstrap liquidity for the newly deployed hyUSD, Hydra DAO proposes an initial allocation of 20,000 HYDRA per month — or ~$24,000 per year at current prices — under a pilot Ecosystem Incentive Program. The goal is to show, with a small controlled budget, how combining hyUSD’s base yield with DAO emissions can achieve powerful capital efficiency and liquidity growth.

Understanding APR and TVL — the Core Relationship

Understanding APR and TVL — the Core Relationship

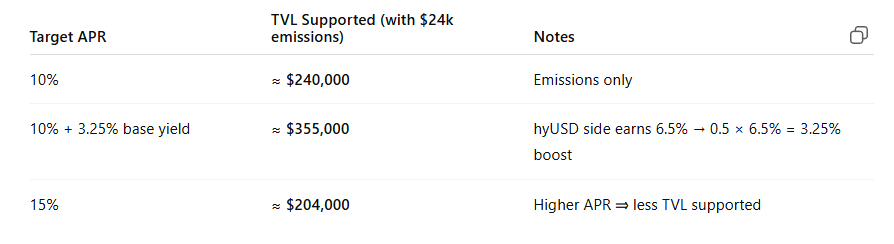

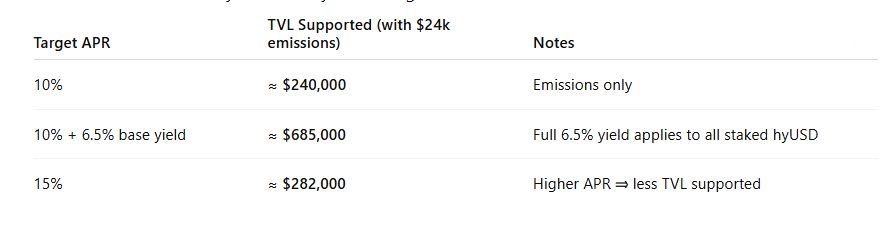

In every DeFi incentive program, APR and TVL are inversely connected. The formula is simple:

TVL = (Total Emissions ÷ Target APR)

If the DAO distributes $24,000 per year, and the target APR for liquidity providers is 10%, then: → $24,000 ÷ 10% = $240,000 in supported TVL

If APR expectations fall to 5%, the same $24,000 supports $480,000 TVL — twice as much. If expectations rise to 15%, supported TVL shrinks to $160,000.

That’s why this dynamic matters:

-

Higher TVL means greater liquidity depth, tighter trading spreads, and stronger confidence.

-

Lower APR means the DAO’s capital is working more efficiently — each emission dollar brings in more user capital.

In both cases, the ecosystem benefits. As confidence grows and risk perception falls, the natural market forces pull APR down and TVL up — a sign of ecosystem maturity.

Why hyUSD Amplifies Efficiency

Why hyUSD Amplifies Efficiency

The true power of hyUSD lies in its built-in, compounding collateral base. Because every hyUSD is backed 1:1 by an externally yield-generating asset (currently sUSDe), the token itself carries yield boosting potential into every pool or staking vault it touches. That means DAO incentives are no longer the sole source of yield — they become a multiplier on top of an already performing base layer.

In practical terms, this turns emissions into leveraged liquidity tools: each dollar of HYDRA distributed by the DAO attracts more dollars of liquidity, because part of the return is already financed by hyUSD’s underlying collateral. The result is amplified TVL efficiency — the DAO spends less to sustain more liquidity depth, and the ecosystem gains a compounding advantage that strengthens over time.

Option 1 — hyUSD / USDC Pool

Option 1 — hyUSD / USDC Pool

-

Emissions: $2,000 / month

-

Focus: Attract external stablecoin liquidity and cross-chain participants

-

Tradeoff: Dual-asset exposure (impermanent loss risk)

-

Mechanism: LP pairing between hyUSD and USDC on Hydra’s DEX

Interpretation: Even modest external yield from hyUSD improves efficiency dramatically — with no extra DAO cost. Each percentage point of underlying yield effectively reduces the cost of liquidity acquisition, as the base yield substitutes for emissions.

Option 2 — hyUSD Single-Asset Staking

Option 2 — hyUSD Single-Asset Staking

-

Emissions: $2,000 / month

-

Focus: Maximize TVL efficiency and strengthen native liquidity

-

Tradeoff: Narrower scope, no external pair

-

Mechanism: Stake hyUSD directly into a single-asset vault

Interpretation: When every staked dollar earns the full 6.5% from the underlying sUSDe collateral, DAO emissions act as a multiplier rather than the sole incentive. The same emissions can attract ≈3× more liquidity than a dual-asset pool while removing impermanent loss altogether.

The Strategic View: How Scale Affects APR

The Strategic View: How Scale Affects APR

In established ecosystems with billions in TVL, trust and liquidity are self-reinforcing — users accept single-digit APRs because capital risk is perceived as low. In smaller or emerging ecosystems, capital demands a premium: participants expect higher APRs to offset perceived market or adoption risk.

This isn’t weakness — it’s market physics. Hydra’s strategy is to counter that friction intelligently by stacking base yield from external assets like hyUSD, effectively subsidizing the risk premium without increasing emissions.

The result is a competitive APR at a fraction of the cost, giving Hydra the same magnetic effect as larger ecosystems — but achieved through design, not overspending.

Summary

Summary

-

20,000 HYDRA per month ( ~$2,000/month @ $0.1 price) in DAO emissions

-

Based on discussion to decide whether for hyUSD/USDC dex pool or as direct/isolated staking incentive for hyUSD

-

At 10% APR, emissions alone support ≈ $240k TVL

-

Add hyUSD’s 6.5% base yield, and that range expands to $350k–$680k TVL, depending on configuration

-

Each % of external yield amplifies DAO capital efficiency

-

Both outcomes — high TVL or lower APR — signal ecosystem strength, either by growth or cost efficiency

Target Goals

-

Boost Hydra’s on-chain TVL, strengthening liquidity depth and volume potential across the ecosystem.

-

Increase competitiveness with larger DeFi ecosystems by using design-driven efficiency rather than inflated emissions.

-

Showcase Hydra’s advantage — where yield-integrated assets like hyUSD make each DAO dollar go further.